I’ve always preferred chocolate on the darker side rich, slightly bitter, and packed with flavor. It got me thinking: why do some chocolate bars stand out more than others? To satisfy my curiosity, I explored a global dataset of chocolate bars, analyzing ratings, cocoa content, bean origins, and brand strategies. The insights were clear, the highest-rated chocolates consistently share two traits: optimal cocoa percentage and strategic sourcing of premium beans. Let’s dive in to see exactly how these elements shape chocolate quality.

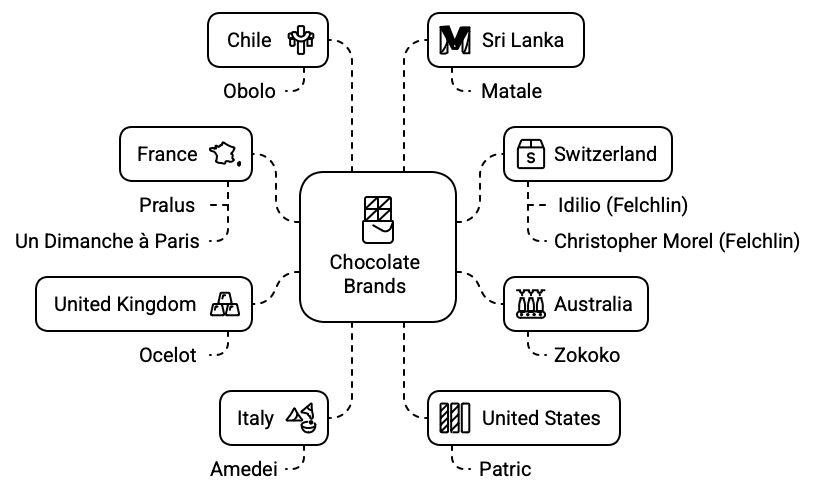

Chocolate is a global craft. From European artisans like France’s Pralus and Switzerland’s Felchlin to innovators like Australia’s Zokoko, Britain’s Ocelot, America’s Patric, Italy’s Amedei, and even Chile’s Obolo, excellence knows no borders. My analysis spans brands from nearly every continent, underlining just how universal the pursuit of premium chocolate is.

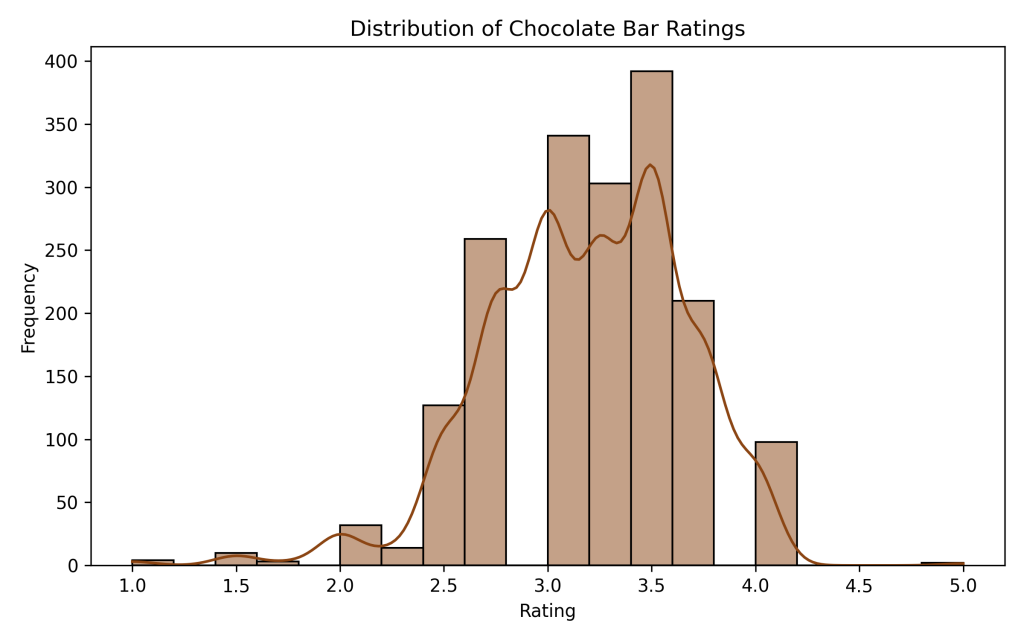

To start, I looked at how chocolate bars are rated. Most chocolates earned ratings between 3.0 and 3.5 out of 5 a clear middle ground. Very high and very low ratings were rare, suggesting the industry generally maintains decent standards but few bars truly stand out as exceptional.

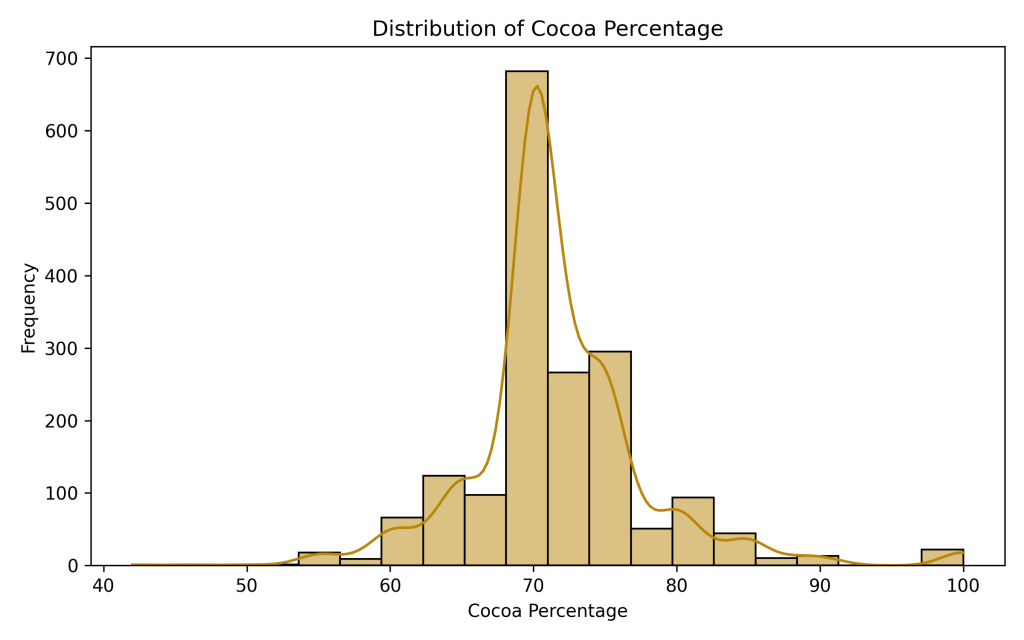

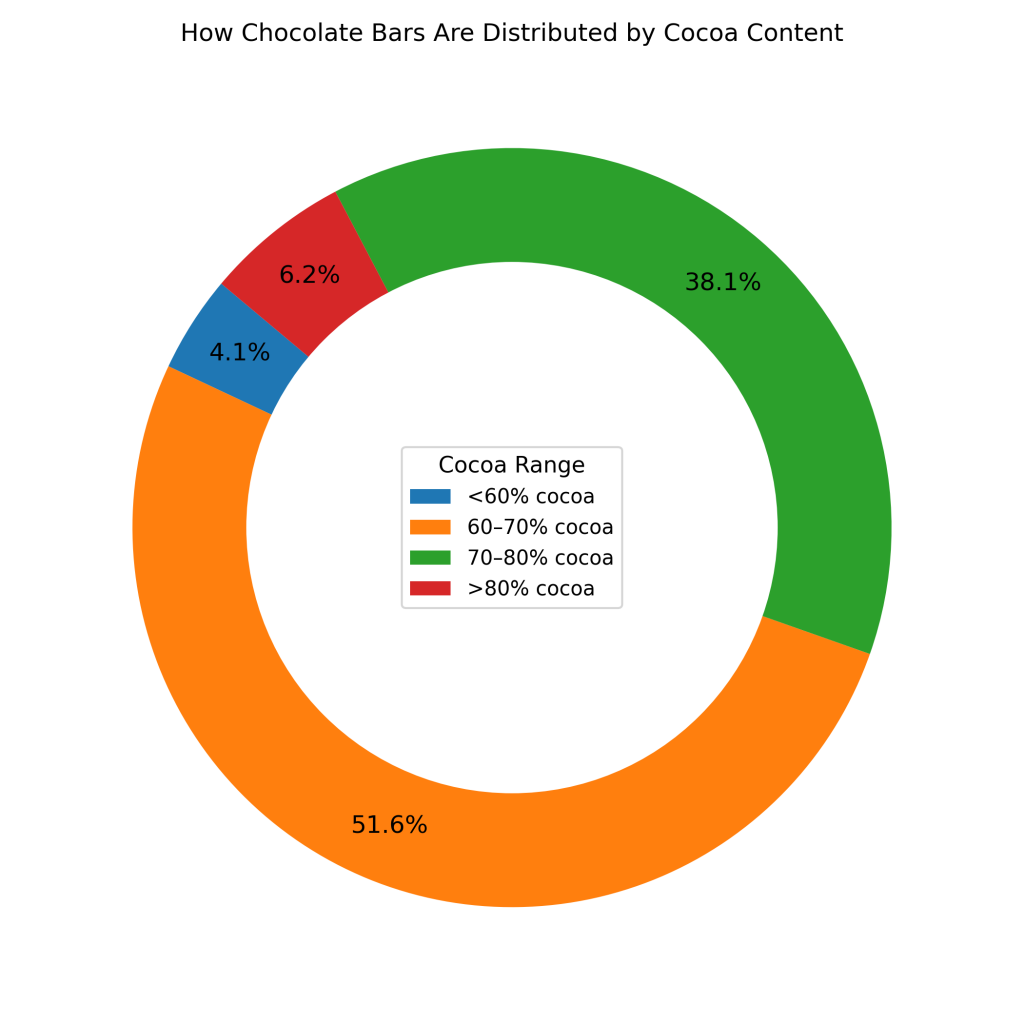

Next, I explored cocoa percentages. Most bars fell within a sweet spot between 60% and 75% cocoa, with a significant peak around 70%. It’s clear chocolate makers have found a balanced flavor intensity here rich yet not overwhelming. Once cocoa content surpasses 80%, consumer preference quickly drops, as ultra-dark chocolates become too bitter for mainstream tastes.

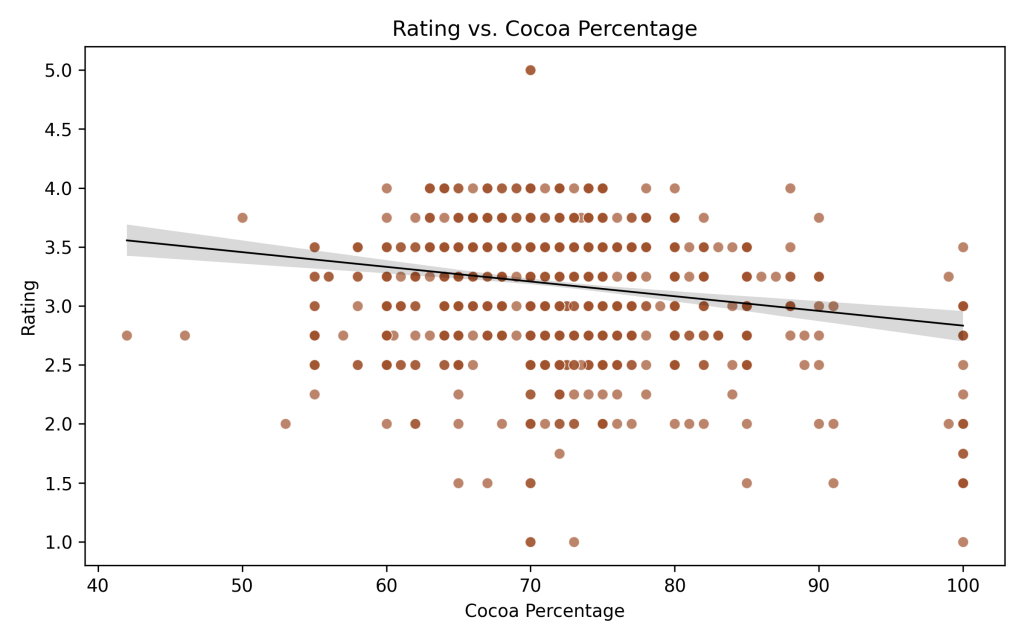

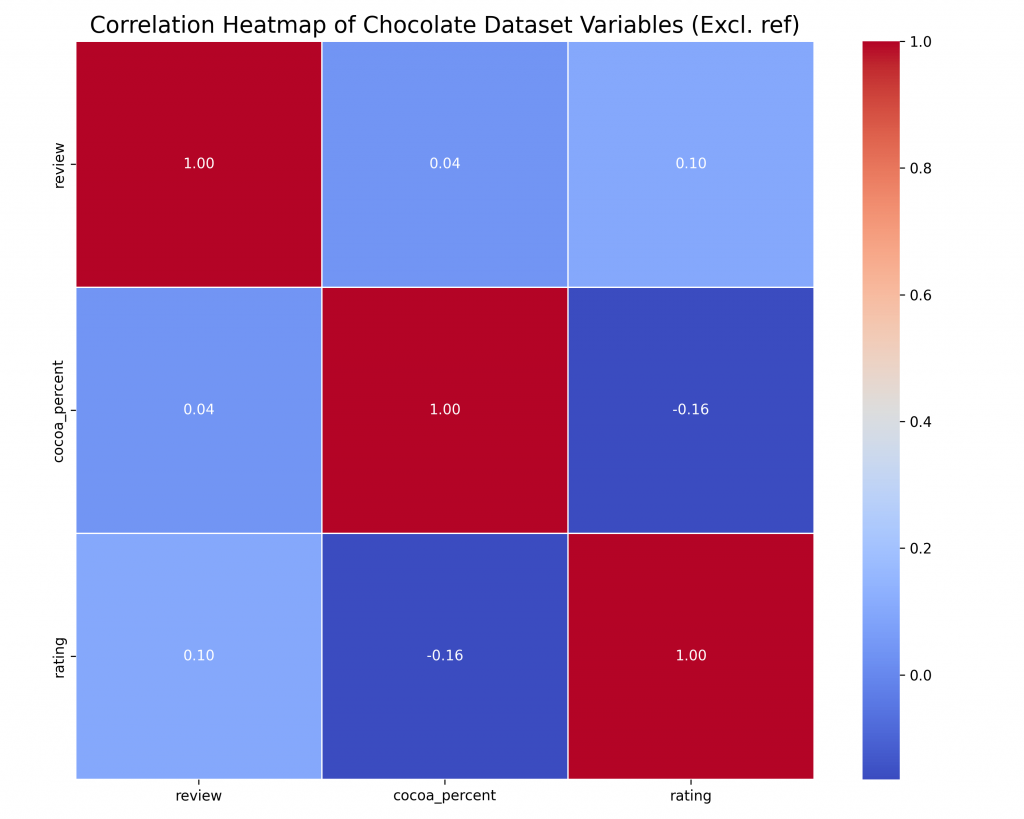

But does higher cocoa content mean better chocolate? Interestingly, the data revealed otherwise. A slight negative correlation emerged, higher cocoa percentages sometimes lead to lower ratings. It seems that too much intensity can push chocolate into overly bitter territory, limiting broader appeal. Clearly, « more intense » isn’t always better.

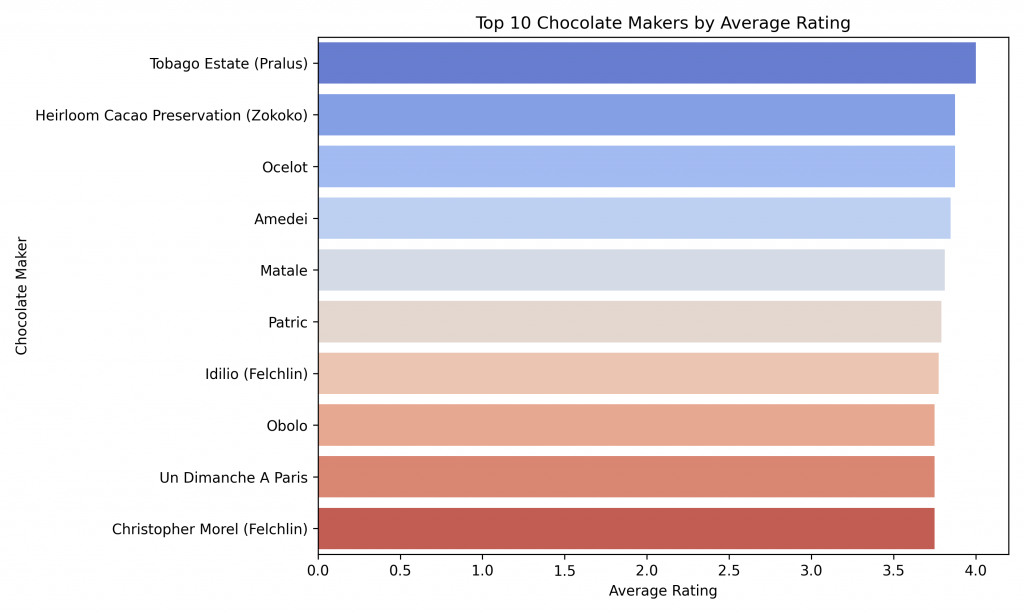

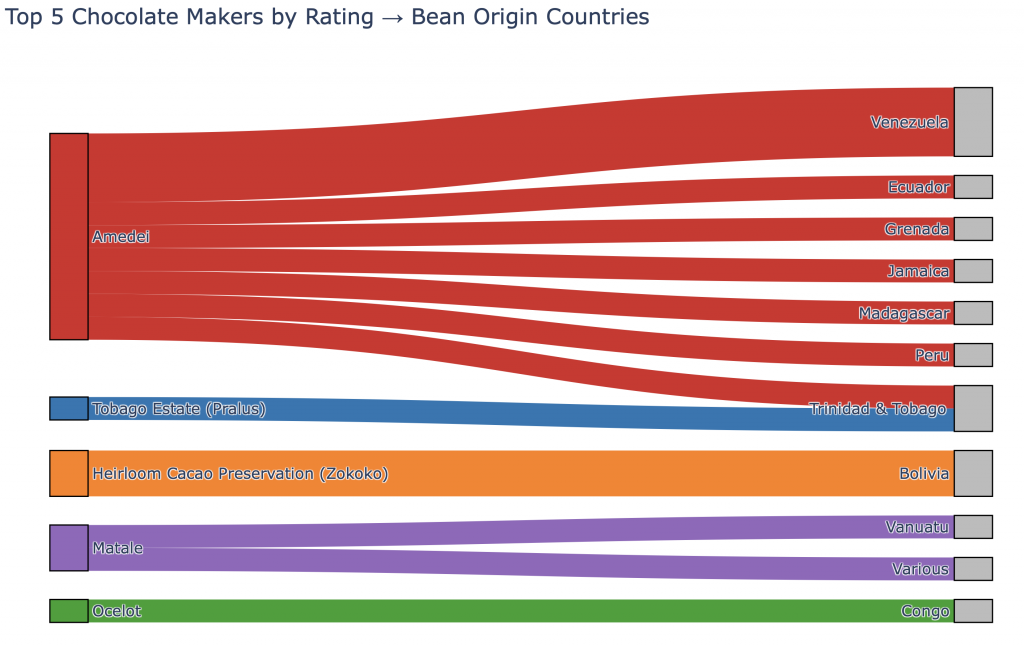

Identifying top-rated chocolate makers brought forth some clear frontrunners: Tobago Estate (Pralus), Zokoko, and Ocelot consistently achieved high ratings. Remarkably, these top-performing chocolatiers hail from different parts of the globe, affirming that premium chocolate craftsmanship isn’t geographically bound but cultivated internationally.

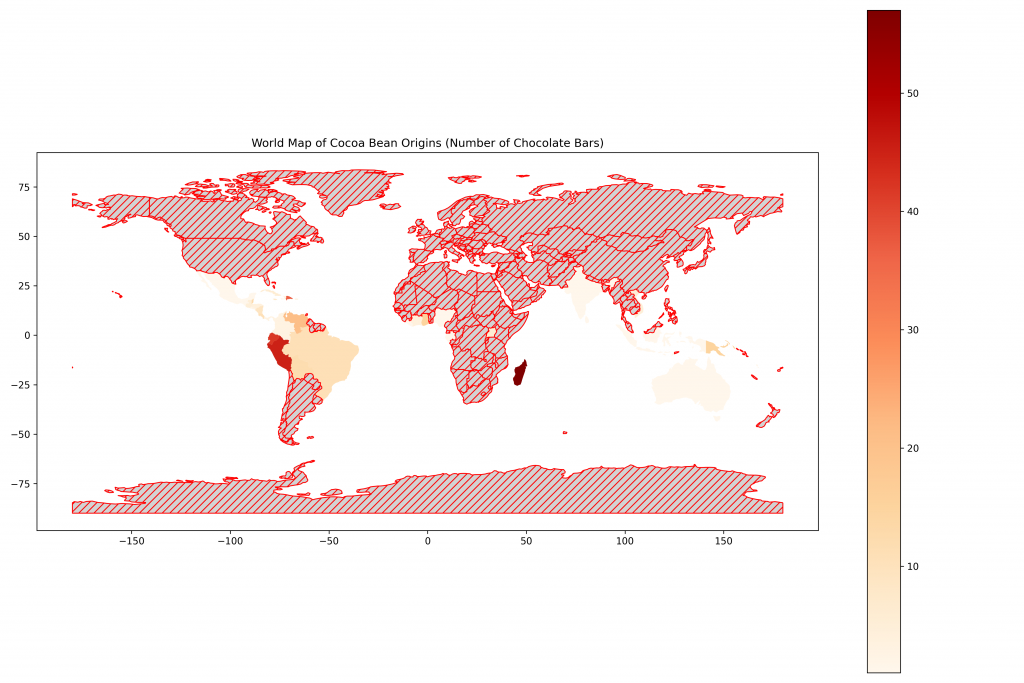

To better understand this, I mapped the origins of cocoa beans. Premium chocolates often sourced beans from places renowned for quality—Peru, Ecuador, and Madagascar. Noticeably less represented were major production regions like Central Africa and Southeast Asia, suggesting a distinction between quantity-focused and quality-focused cacao sourcing.

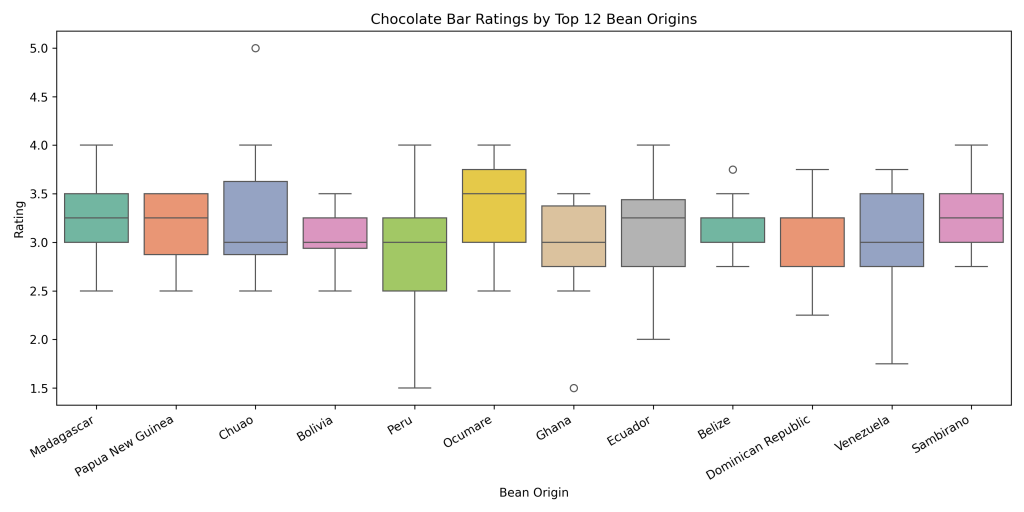

Digging deeper, quality varied by specific region. Venezuelan regions like Ocumare and Chuao stood out with consistently high, closely clustered ratings, signaling reliability. In contrast, Peruvian beans had wider variation, indicating origin alone doesn’t ensure excellence, artisanal handling plays a crucial role, too.

Consumer preferences reinforced this idea clearly: more than half the market prefers chocolates between 60-70% cocoa, striking a universal balance. Chocolates below 60% or above 80% cocoa cater to niche tastes, either too sweet or too bitter for mass appeal.

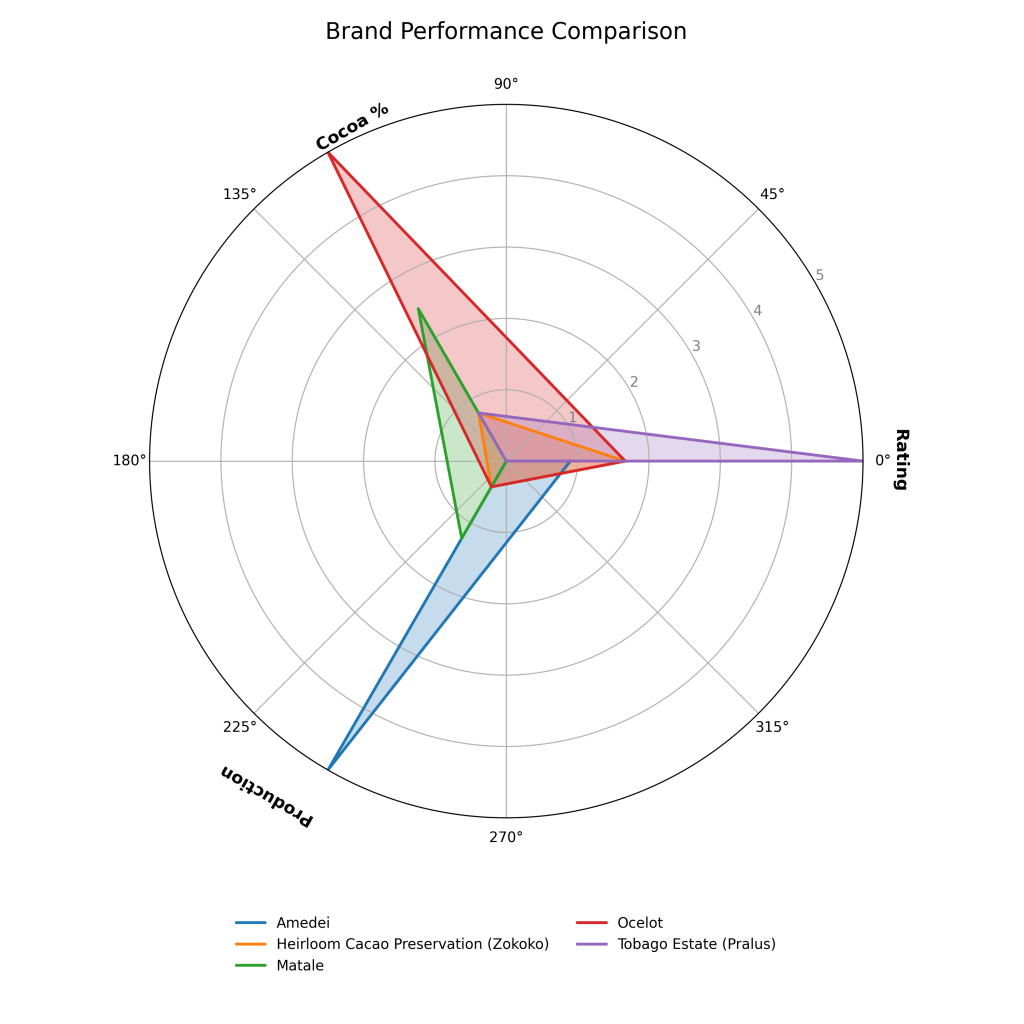

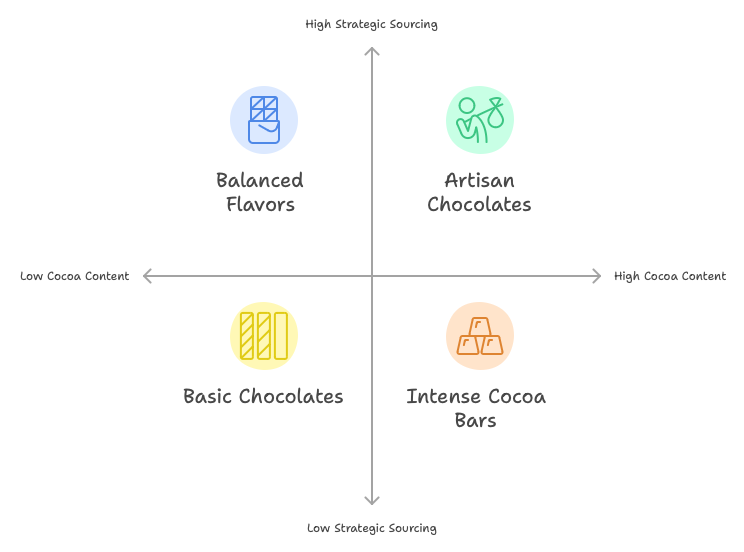

I then compared brands directly. Tobago Estate prioritizes exceptionally high ratings, clearly choosing quality over quantity. Ocelot emphasizes bold cocoa flavors, appealing to serious dark chocolate lovers. Amedei balances premium quality with higher production volumes, while Zokoko and Matale achieve consistent middle-ground positions. Each brand’s distinct strategy shapes its unique chocolate profile.

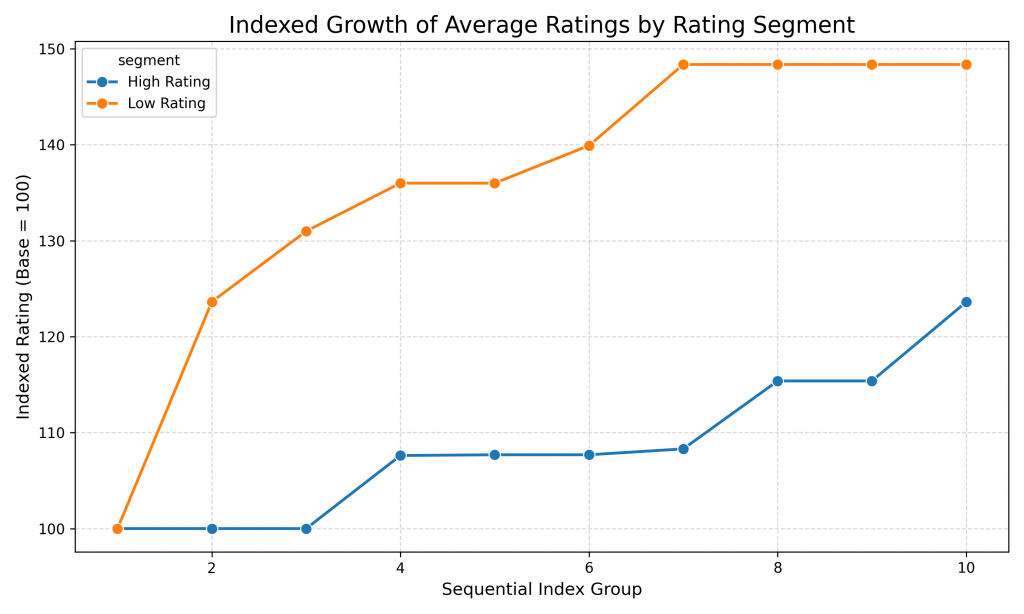

Analyzing trends over time, I found improvement concentrated among lower-rated bars, likely reflecting producers’ responsiveness to consumer feedback. Higher-quality chocolates experienced steady but slower growth, emphasizing their consistent standards and craftsmanship.

A broader analysis of variables reconfirmed earlier observations. There was a subtle yet consistent negative correlation between cocoa percentage and ratings, reaffirming that excessive intensity can diminish chocolate’s overall appeal. Additionally, the relationship between ratings and review counts was mildly positive, but not strong enough to impact definitive conclusions.

Lastly, sourcing strategies proved critical. Brands like Amedei strategically source cacao from multiple global regions to craft complex flavors. Conversely, makers like Zokoko and Tobago Estate focus predominantly on single-origin beans, highlighting terroir-specific qualities. Clearly, sourcing isn’t just logistics, it’s a deliberate strategic choice shaping chocolate quality.

Ultimately, exceptional chocolate isn’t accidental, it results from careful choices, from cocoa percentages to strategic sourcing and meticulous craftsmanship. Through intentional decisions, chocolate makers elevate their products, creating bars that don’t just taste good but stand out as truly exceptional.

Reference

https://www.kaggle.com/datasets/rtatman/chocolate-bar-ratings