Inflation is defined as a general increase in the prices of goods, commodities (like crude oil, gold, wheat, or livestock), and services in an economy, coupled with a fall in the purchasing value of money.

In recent years, the world has perceived many hardships, including worsening climate change, wars, natural and manmade disasters, and most importantly the COVID-19 pandemic. The global data that was used in this study for food and energy was retrieved from 2021. As for data related to worldwide fuel and gold prices, they included numbers from the year 1999 up until 2022. These years have witnessed terrible deterioration on all levels, especially the economic one.

All these have transformed the economy of the world and have led to supply chain disruptions, unemployment, increased production costs, as well as disturbance in monetary policies, which all influence inflation. This analysis will explore the effect of different factors on prices of goods and commodities globally and will analyze the relationship between fuel prices and gold prices. Therefore, did the different events that occurred throughout the years up until today influence the energy and food prices in certain countries? And is there a relationship between increasing gold and fuel prices worldwide?

To answer our hypotheses, the analysis was conducted using Power BI, where the data was visualized and interpreted with the help of a heat map, histograms, plots, a line chart, and a tree map

Energy price inflation

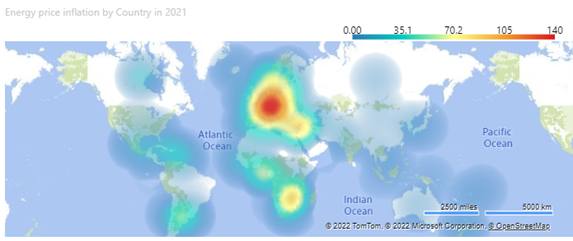

In this map, the darker the color, the higher the energy price inflation is in that area. As we can see in the heat map below, energy prices inflation in 2021 seems to be mostly influencing countries in Europe and in the Middle East, as well as southern Africa to a certain extent. In fact, this inflation was influenced by the COVID-19 pandemic’s repercussions which are still apparent up to this day, which triggered a sharp increase in energy prices, affecting Middle Eastern and European countries, where most countries relied on import of oil and gas. In addition, the situation is particularly worse for countries in conflict areas such as Syria, or countries experiencing a sharp economic crisis like Lebanon. We can see through this map that energy price inflation isn’t much of a problem for oil exporters, such as Gulf countries, Russia, Australia, and Canada.

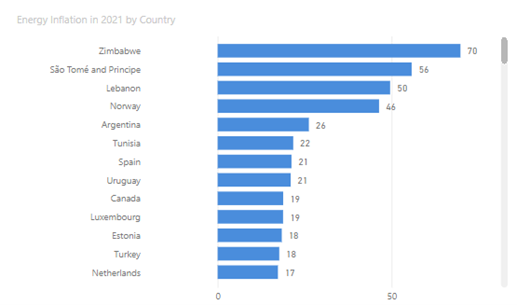

The below horizontal bar chart, confirms the earlier findings in the map, indicating that countries in Africa (Zimbabwe 70% & São Tomé and Principe 56%), the Middle East (Lebanon 50%) and Europe (Norway 46%) had the highest rates of energy inflation in the year 2021.

Food price inflation

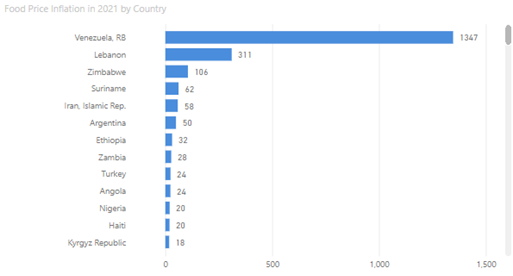

According to the below horizontal bar chart, two countries which were mostly suffering from the highest inflation rates for energy prices, are also among the ones suffering from the highest inflation rates for food prices among other countries, which include Lebanon (311%) and Zimbabwe (106%), given the high dependence of these economies on the import of foreign food, especially in low-middle to low-income countries. However, a new country which appeared in this category, and which seems to be the most intensely hit by food price inflation is Venezuela (1347%) which has been known to be going through an economic collapse, which has been worsening since 2017. It can also be inferred that food prices are significantly impacted by energy prices, according to a study by Taghizadeh-Hesary et al. (2019).

Gold prices and Fuel prices

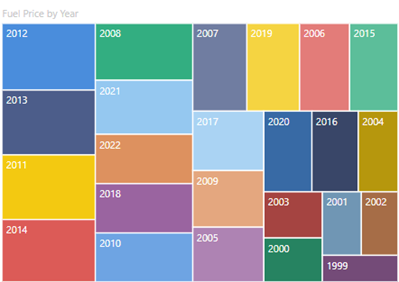

Additional commodities whose prices were also influenced by inflation are gold and fuel. In fact, as the tree map below shows (see Figure 4), fuel prices have been highest between 2011 and 2014, namely in 2012. According to CNN, possible reasons for spikes in fuel prices in 2012 were due to hurricanes in America, as well as due to tensions and sanctions in many countries in the Middle East. 2021 and 2022 also held big shares of fuel prices increase due to COVID-19, as well as due to a global economic crisis, exacerbated by the Ukrainian-Russian conflict.

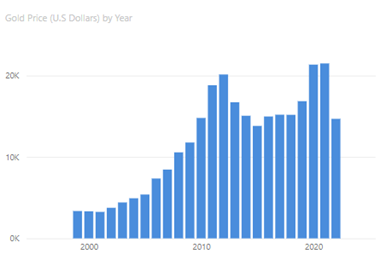

A very similar pattern can be seen when it comes to global gold prices as well; the year 2012 has observed a spike in gold prices. The years 2020 and 2021 have also seen an increase in gold prices, namely due to the global economic crisis amplified by the calamitous effects of the COVID-19 pandemic.

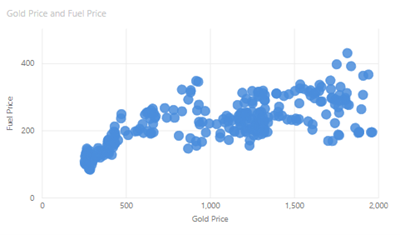

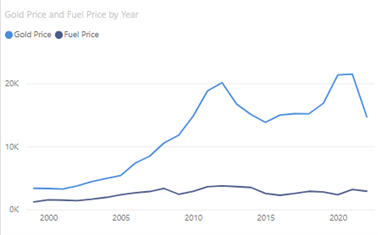

After seeing the above visuals, one should ask is there a relationship between gold prices and fuel prices? The answer is yes. In the below scatter plot (see Figure 6) each dot represents two values: one for a gold price and the other for the fuel prices. The scatter plot shows a positive linear relationship between fuel prices and gold prices in USD; for example, for a fuel price of $200, the gold price was $500, and for a fuel price of $400, gold prices reached about $1750. Furthermore, the line chart (see Figure 7) indicates that in the same periods where gold prices witnessed spikes, fuel prices were also observing a slight increase, as we can see in 2012 and in 2021.

Conclusion

In conclusion, the data visualized above has shown how different circumstances throughout distinct years have an effect on prices of different commodities globally, and that fuel prices might affect gold prices, and vice versa as we were able to see a positive linear relationship between the two variables.

References

https://www.imf.org/en/Blogs/Articles/2022/05/24/blog-mena-commodity-importers-hit-by-higher-prices

https://www.sciencedirect.com/science/article/pii/S0301421518308486

https://money.cnn.com/2012/12/31/news/economy/gas-prices/

https://www.cairn.info/revue-economie-internationale-2012-3-page-71.htm

https://www.worldbank.org/en/research/brief/inflation-database